If you’ve been active in the personal finance and fintech scene, you would probably have heard about Robo-advisor terms being flying around these past few years.

I first heard about Robo-advisor in mid-2019 but apparently, they have been around since 2010 with the first such service in Malaysia in 2018 with Stashaway.

But Wahed is different because they are US-based and focus on Shariah-compliant stocks.

What is a Robo-Advisor?

The short version is that they are a type of service which gives wonderful advice to customers. Financial advice. The longer version: Robo-advisor is a platform that offers financial and investment advice based on mathematical algorithms and software.

If they sound fishy to you, just know that there are scientists, economists, and mathematicians behind the algorithms. Sounds convincing…right?

Traditionally, banks and/or institutions provide these services through their advisors, agents, and fund managers to deliver these services. These intermediaries add to the overall cost structure, making them expensive for most.

Robo-advisor eliminates these intermediaries so they can provide the same service at a much lower cost. Lower cost equals a higher return for us. Yeah!

Also, Robo-advisor helps to allocate investments into assets such as stocks, Sukuk (bonds), and commodities based on the client’s risk appetite and goals.

Wahed Invest invested their client’s money into a bunch of ETFs. Which brings us to…

What Are ETFs?

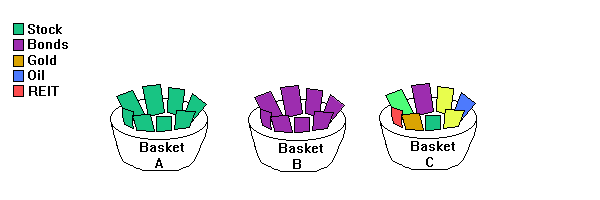

ETFs or Exchange-Traded Funds is an investment funds which is traded on the stock exchange such as Bursa Malaysia. A simple analogy to describe ETFs is that they are a basket that holds a collection of securities. Refer to my colourful drawing below:

Basket A is an ETF that holds a collection of stocks and ETF B holds a collection of bonds (Sukuk). They are not restricted to holding only one type of asset but can be a collection of different assets (Basket C). ETFs are generally favourable due to the lower fee, diversification, and ease of exchange that they offer.

Wahed Invest Robo-Advisor

Wahed Invest is one of the first Robo-advisors that focused on investment in Shariah-compliant assets. The firm was established in the US in 2015 and expanded into other countries shortly after.

In Malaysia, they were licensed by the Securities Commission (SC) and started to operate on 30th October 2019. Naturally, I was drawn to give them a try and in December 2019, I opened my account with Wahed Invest.

It’s been 53 months or over 4 years since I invested my money in Wahed. Here is my journey so far.

My Journey with Wahed Invest So Far...

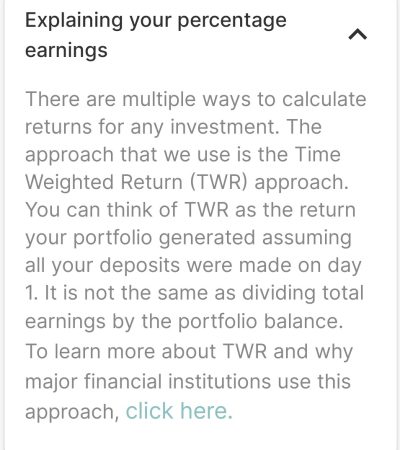

Wahed Invest uses Time Weighted Return (TWR) in their calculation. So, the percentage return might not be the same as the Money Weighted Return (MWR) that we are usually familiar with.

Time Weighted Return takes into account the amount of deposits and withdrawals that you made in a certain period, divides them into sub-periods, and sums up the returns of each sub-period into a final amount. Or here’s how Wahed explain:

Within these 4 years, I’ve made a total of 27 deposits, which is roughly once every other month. I’ve been more consistent in 2020 to 2021 but it’s been going downhill for the last 2.5 years.

So, the big reveal is…

For the total of 53 months invested, my return was 50.6%. I can’t really show the exact value, but I can share in terms of percentage return. Since this is a TWR calculation, it doesn’t mean that if I started with RM 1000, the money is now RM 1500.

Instead, if I convert this to MWR, the return will be 37.6% over 4 years or 9.4% per annum. I would say that it’s not that bad at all.

Where Wahed Invest?

So, where did Wahed Invest invest my funds to get such a good return? At present, there are 5 categories which Wahed Invest allocates my portfolio into. They are:

- Global Stocks

- Emerging Market Stocks

- Sukuk

- Gold

- Cash

Global Stocks: Wahed FTSE USA Shariah (HLAL) & Wahed DJ Islamic World ETF (UMMA)

For global stocks, Wahed further diversified into HLAL (50.64%) and UMMA (21%). Both funds are listed on NASDAQ. My guess would be the percentage allocated will be different for different risk portfolios.

HLAL fund is heavily invested in the Manufacturing and Information sectors, which includes companies like Abbott Laboratories, AMD, Apple, and Tesla.

On the other hand, UMMA heavily invested in Technology Hardware & Semiconductors and Healthcare. This includes Infineon, AstraZeneca, and Novo Nordisk.

Yeah, you got quite a good exposure to the top global companies. Cool.

Sukuk: Malaysia Maybank Sukuk Fund

Malaysia Maybank Sukuk Fund is a fund managed by Maybank Asset Management and aims to provide annual income to conservative investors. They mostly invested in the Infrastructures & Utilities and Property & Real Estate sector.

Among their top holdings are Country Garden, MRCB, Konsortium Lebuhraya Utara-Timur (KL), and Tanjung Bin Energy.

(Source)

Emerging Market Stocks: HSBC MSCI Emerging Markets Islamic ESG UCITS ETF

This ETF is managed by HSBC International and is made up of large and mid-cap companies across 24 emerging markets countries and also comply with Shariah investment principles. The 24 countries include China, India, Saudi Arabia, Brazil, Thailand and others.

Among their holdings include Reliance Industries (India), Saudi Telecom (Saudi Arabia), and Kunlun Energy (China).

(Source)

Gold: TradePlus Shariah Gold Tracker

This ETF tracks the returns of gold to provide investors with a Shariah-compliant avenue to invest in physical gold without the hassle of storing or insuring gold bullion.

(Source)

Cash

Pretty straightforward. Wahed reserves some cash in our portfolio for quick transactions including when we are withdrawing money for our portfolio or portfolio rebalancing exercises.

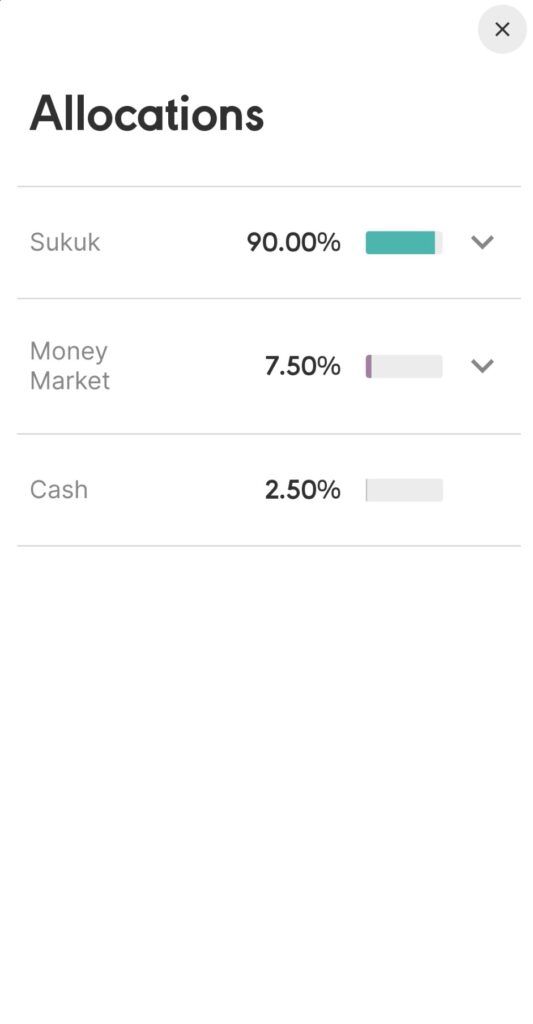

However, Wahed Invest did not allocate my funds equally to these assets. Instead, the percentage allocation for each category depends on our portfolio selection from Very Conservative to Very Aggressive.

I chose an Aggressive portfolio and below is how Wahed allocates my money:

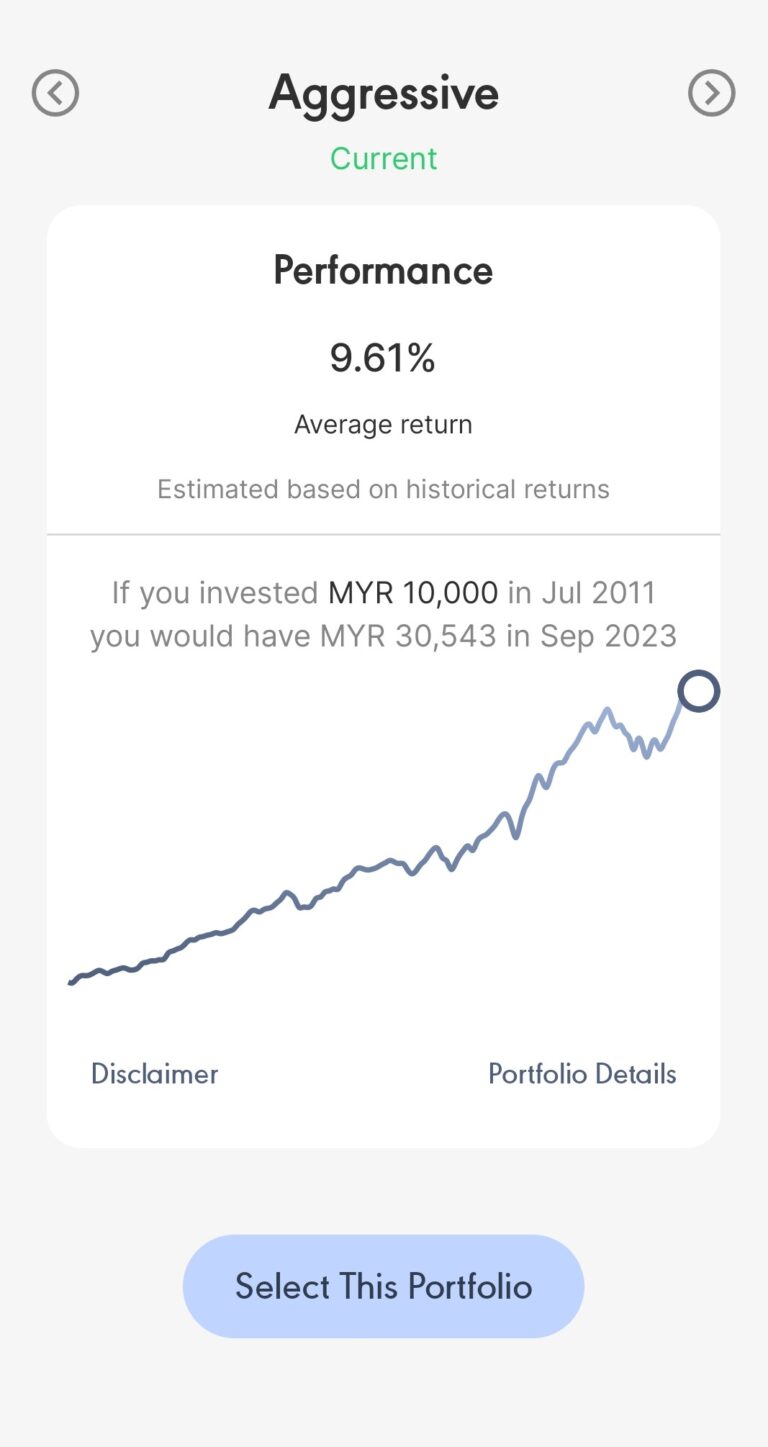

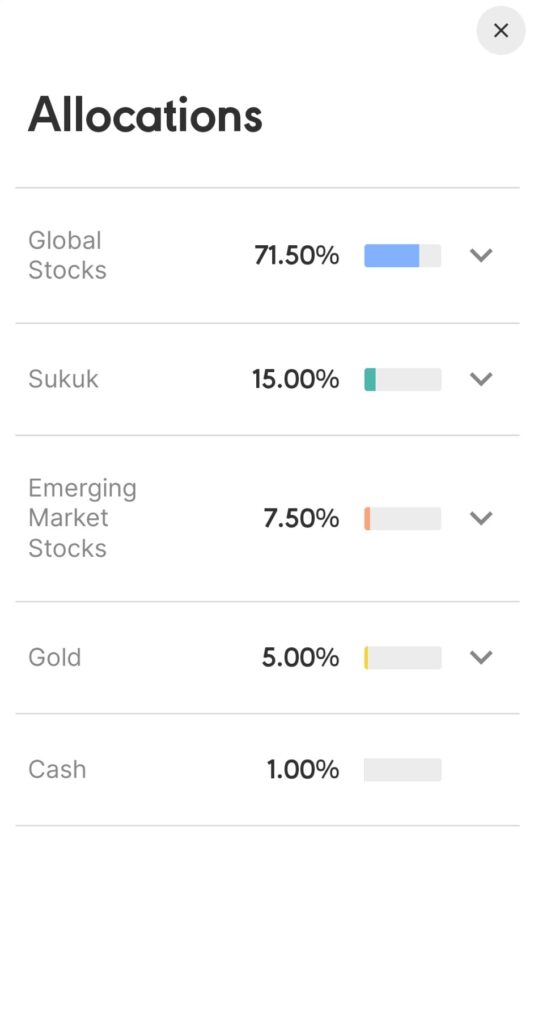

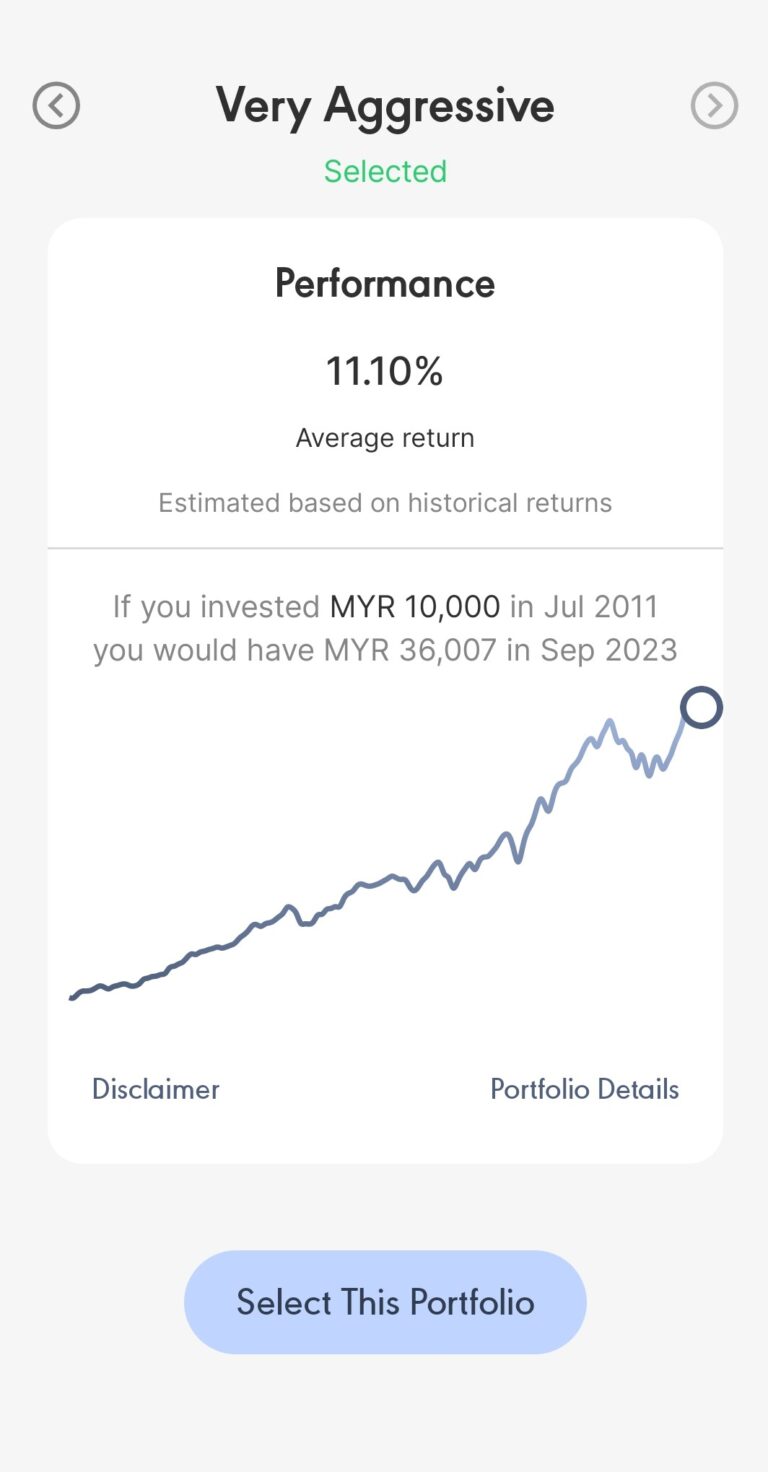

If I choose a Very Aggressive portfolio, the historical returns and percentage allocation will be:

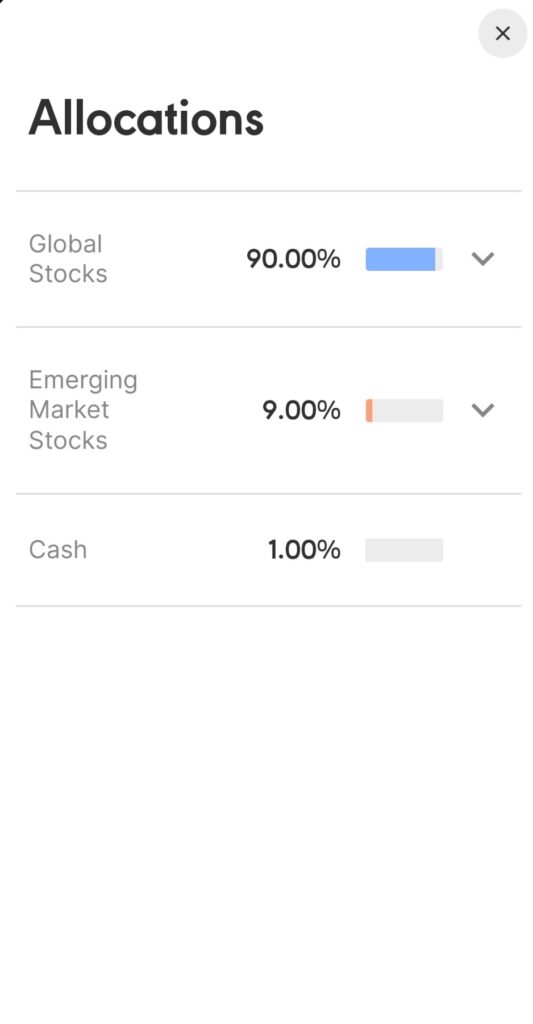

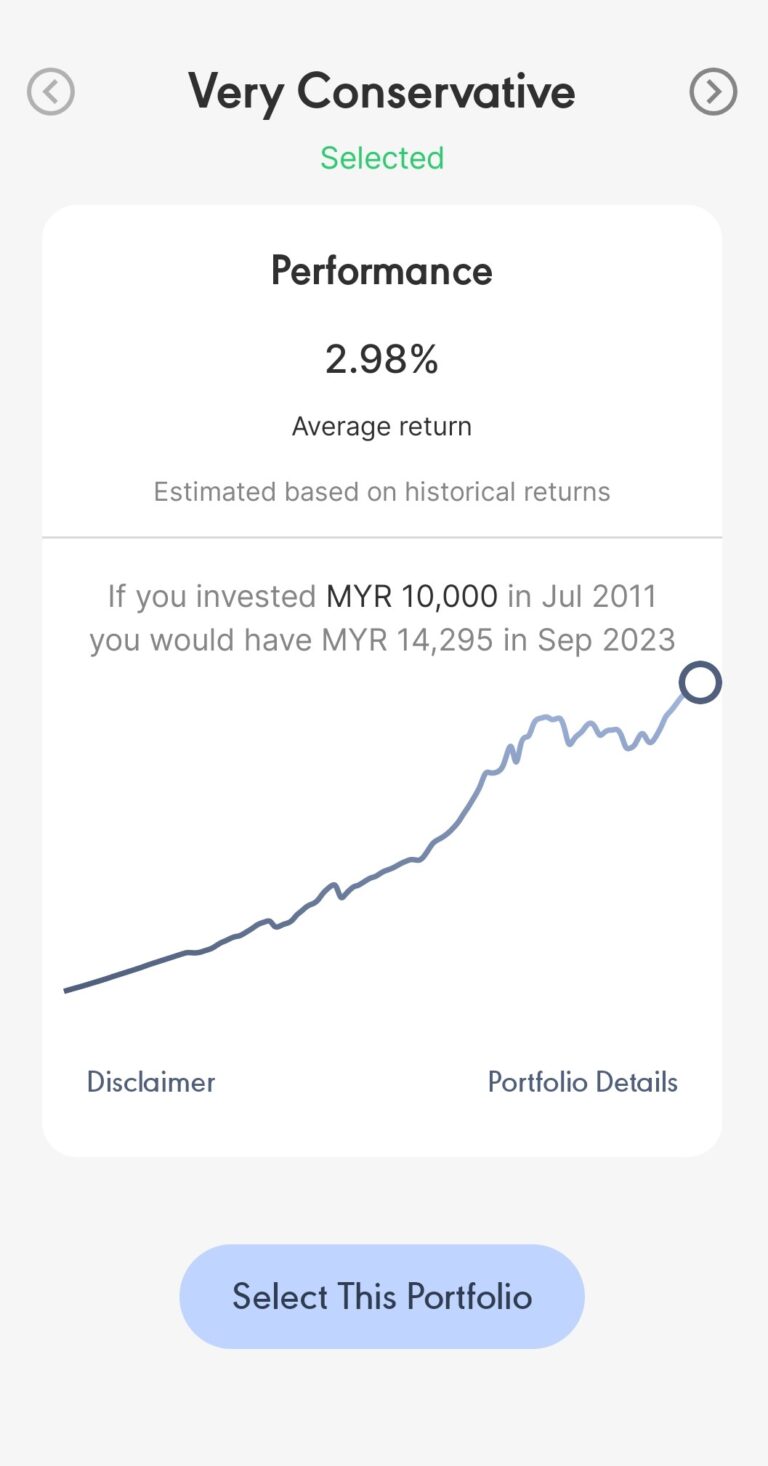

On the other end of the spectrum, if I opt for a Very Conservative portfolio, the historical returns and percentage allocation will be:

You can change your portfolio anytime within the apps. A general rule of thumb is high risks offer a high return, but the potential loss is also high.

Great! How to Start Investing with Wahed Invest?

So, if investing with a Robo-advisor sounds great, you can give Wahed Invest a try. To start, simply download Wahed Invest apps from Google Play or Apps Store. Below is a step-by-step guide to set up your Wahed Invest account.

The interface might be slightly different if you are using iOS.

Sign up by filling in your email and creating your password. You will be using this email and password as your login credentials. Next, fill in your location and whether you are a US citizen or not.

Next, you need to answer a questionnaire for Wahed Invest to suggest a suitable portfolio according to your risk profile. Do note that you can choose a different portfolio than what Wahed Invest suggests. Your selection will be permanent so, think carefully before choosing.

Fill in your residential address, mailing address, phone number, and answer some questions to proceed.

Review and ensure your details are correct then, scroll down the screen and click on “Do you have a referral code?” Enter my referral code, mohbin241 to earn an extra RM 10. Do note that you have to deposit a minimum of RM 300 in your account to receive the RM 10 bonus.

DISCLAIMER: I will also receive RM 20 referral bonus but the money is not from your fund. They are from Wahed Invest for helping them to refer to more people. Hope this helps to clarify.

ACTIONABLE TIPS: If the idea of giving away your money to a robot for an investment sounds scary, start researching on your own. This is a great article on Robo-advisor from iMoney. If it still doesn’t sit well with you, there are still tons of other ways to start investing.

End.

Have you invested with Wahed Invest? Share your thoughts, progress, and questions in the comment section below.